2025 - THE SESQUICENTENNIAL

This is the 150th anniversary of R. J. Reynolds Tobacco Company. Reynolds American is emphasizing the relationship between the Company and the people of Winston-Salem - what they have meant to each other for a century and a half.

Reynolds American management asked me to trace the history of the company’s stock. Reynolds stock (RJR) was first made available to the public in 1912. Richard Joshua Reynolds opened his little factory in Winston 37 years earlier with a $7,500 investment.

The little chewing tobacco company grew 32% a year, and in 1898 James Buchanan (Buck) Duke’s American Tobacco Trust bought 2/3 of Reynolds, valuing the company at $4.5 million. RJR flourished under the Trust, but he was never happy with “the New York Crowd” controlling his business. In 1912, the government forced the Trust to divest its holdings, and RJR got his company back. He sold stock in a public offering valuing the company at $25 million, a growth rate of 13% over the 14 years in the Trust.

This table shows that growth from the beginning until Reynolds took his company public, In 1912 it was a major enterprise, having bought many of its competitors in Winston.

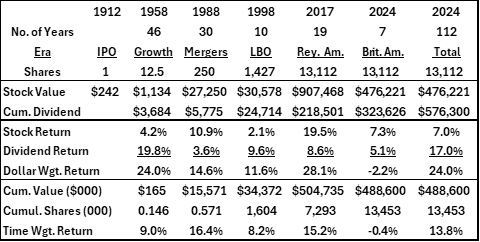

Another 112 years of success would follow for the public company. R. J. Reynolds Tobacco and its stock had 6 distinct “Eras,” each with a changing and unique company culture.

1912-1958 Growth –To encourage his employees to own shares, Reynolds created a special RJR “A” Stock. The “A” stock paid a profit-sharing bonus dividend and the regular dividend to any employee/owner. The next year, 1913, Reynolds introduced his Camel cigarette. This brand delivered higher profits for many years, along with later brands, Winston and Salem.

In 1958, a tax ruling forced RJR to stop the bonus, and each share of “A” stock converted to 1.25 shares of Common stock. The “A” stock had an annual return of 24% for 46 years. The wealth from this stock impacted employee lives and the city of Winston-Salem.

1959-88 Diversification, Empire, and Leveraged Buyout – Reynolds began 30 years of investing in non-tobacco businesses, with poor results because few businesses had financial returns equal to tobacco. Still, RJR built a worldwide “empire” in shipping, oil, foods, and tobacco. In 1988, KKR, a buyout firm, bought Reynolds in an auction, at more than double what the stock had sold for only a few weeks earlier. The “Barbarians” had seized the empire. The sale price proved to be more than the buyer, KKR, would realize from the deal. This high price was a windfall for the stockholders, but many of them were distraught that someone was “taking” their RJR stock from them.

1989-1998 The Dark Age – KKR had financed the deal with $28 billion of debt, carrying interest of $10 million a day. For the next decade, Reynolds Tobacco had to return all its cash flow to KKR to reduce debt. RJR Tobacco was left with no resources to compete effectively. The profit and stock values for this decade assume that Reynolds Tobacco had remained a stand-alone company and that the shareholders’ money received from the buyout was reinvested in this private company. The results are a reasonably accurate “bridge” between the RJR stock sold in 1988 and the new RJR stock that would later emerge. CEO Steve Goldstone achieved the breakup that KKR had envisioned a decade earlier but could not accomplish. He sold Nabisco, the food business, to Kraft (owned by Altria) and RJR Tobacco International to Japan Tobacco. Then, he had a public stock offering of a new R. J. Reynolds Tobacco Company.

1999-2017 RJR Tobacco Renaissance - Investors thought the new RJR was a poor investment. Its stock price reflected a dismal investor outlook. But during the next 19 years Reynolds made significant acquisitions and mergers: Brown and Williamson, Lorillard, Santa Fe, and Conwood, forming Reynolds American (RAI). In 2017, British American Tobacco completed its purchase of all the shares of RAI. This yielded the greatest return for stockholders of any era in RJR‘s history, 28% annually.

2018-2024 British American Tobacco - The BAT purchase set the highwater mark for the stock. In the 7 years since the purchase, BAT stock has declined. However, the large dividends almost offset the decline in the stock price. Reynolds American is marketing new non-combustible products in the fast growing “nicotine delivery” industry, reflecting changes that may be another new “Era” for Reynolds American and British American Tobacco.

Summary Results

This table shows the financial value of a single share purchased in 1912 and held through 2024.

Explanation of Terms[i]

Few businesses can boast such a record for its shareholders for the last 112 years. Stockholder dividends totaled $576,000 and the British American shares are worth $476,000. Th Dollar Weighted Return is 24%, with 7% from stock appreciation and 17% from dividends. This investment has been like putting money in a savings account that earns you 24% interest; you withdraw money periodically (dividends) and let the remainder continue to earn 24% interest.

If all the dividends had been reinvested in more stock, the shares of British American Stock would be worth $489 million, a Time Weighted Return of 13.8% a year.

[i] Explanation of Terms

Dollar Weighted Return (DWR), or Discounted Cash Flow Return: The cash flows are measured as money is added to or removed from the investment account. This method reflects most investors’ experience; they likely spend some, or all, the dividends rather than reinvest them in the stock.

Time Weighted Return (TWR): An initial $1 (or share of stock) is traced from the beginning to the end of the measurement period. TWR assumes that dividends are reinvested in the stock. This method is most useful over shorter periods of time. A dramatic fall in the stock price will distort the TWR. If for example, the stock went to Zero, the TWR would be 0.0% no matter how big the dividends during the measurement period.

Great history! It would be great if the old annual reports were available.

Thank you for putting this together.

Wow!