INTRODUCTION

The stocks called the “Magnificent Seven” are now 36% of the S&P 500. They have a 43% return this year; this is 75% of the S&P’s 17% return. Some analysts are warning that this may be a technology bubble. Nobody knows for sure, but the near universally positive outlook for these stocks is troubling. In the market, disagreements can go on for a long time before they are resolved. I can add perspective from my experience in 1980-81.

THE 1980 OIL BUBBLE

Autumn 1980, the energy sector was 33% of the S&P 500 Index. Two personal incidents illustrate the mindset about energy, that we now know was unjustified mania.

I had been away from our oil business for 4 years. I was managing RJR’s pension investment advisors who were buying stocks for us. It was important to make sense of the enthusiasm for energy stocks because one of my charges was to avoid portfolio concentration.

THE OIL EXPERT – AUGUST 1980

Nobody was interested in a contrary opinion on the future of energy. One investment advisor visited me in the fall of 1980. He had recently been an Assistant Secretary in the Department of Energy in Washington, Clearly, he was better informed than most about the world oil market. His company was overweight in oil stocks, and he laid out their case.

Oil had hit a new high, $39 a barrel in June. A few weeks before, he had met with the Saudi Oil Minister, Sheik Zaki Yamani. Everyone in the world was listening to Yamani who was setting Saudi oil prices; Yamani seemed to be the most powerful man in the world. My advisor said that in his meeting, Yamani “had personally assured that by April 1981 oil would hit $100 a barrel” – 2 ½ times the current price – a frightening thought. “Experts” were already declaring that the people would have to cut back on food to buy gas for their cars.

THE BOARD

Shortly after. I gave my annual pension fund report to the RJR board finance committee. This year, taking my cue from the very conservative Capital Guardian Trust advisors, I (cautiously) stated my concern that oil stocks were becoming too big a part of the market. I did NOT say that oil stocks would decline, rather, that they might not be a bargain relative to other stocks. No sooner had I made the comment than one of the directors interrupted and asked, “Did you say oil stocks are going down?” His tone made it clear that he strongly disagreed with what I had said. I clarified and moved on with my talk, but the board clearly thought that I was completely wrong about oil.

November 21, 1980 Wall Street Journal “The Wall Street pros and industry men can think of almost nothing these days that bodes ill for established domestic oil and gas producers’ earnings and stock prices. the list of fundamental “positives” for the industry seems to be growing almost daily. Analysts don’t smell a significant downward correction in the wind. The worst they expect here is a trading correction. Oil stocks rose 12% last week alone and they’re up more than 40% since September 22. For now, while analysts remain leery of the superheated speculative play in junior oil and gas stocks, they continue their buy recommendations on major domestic oils: Standard Oil (Indiana), Atlantic Richfield, Standard Oil (Ohio), Shell Oil and Union Oil of California.”

SPRING 1981 – A REVISED OUTLOOK (TOO LATE)

Spring 1981, the price of crude was far below $100 a barrel, even a bit below $39. Oil would not reach $100 until February 2008, 27 years later. When it comes to major economic and market inflection points, there are no experts!

The man who had talked to Yamani surely believed the Sheik’s assurance that $100 -a- barrel oil would be a reality, and perhaps Yamani believed it himself. The RJR Board had their own view; they were not accustomed to being contradicted or challenged on their strong beliefs. But their status as “captains of industry” did not save them from being as wrong as everybody else.

April 2, 1981 Wall Street Journal “1980 Favorites Were Among Biggest Losers [this year]. Oil-related groups dominated the loss column. Offshore drilling dropped 18.7%, and most oil company groups were off 15% to 16%.”

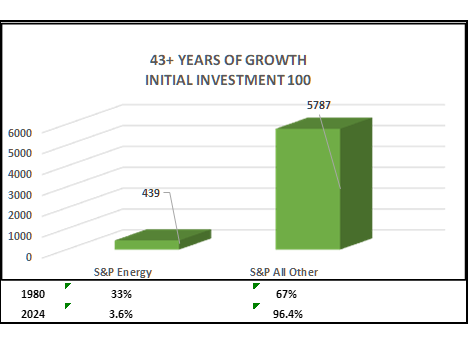

Over the next two years, oil stocks dropped on average 35-50% and many of the smaller companies went bankrupt. 43 years later, the Energy Sector is 3.6% of the S&P 500. $100 invested in the energy stocks at the end of 1980 would have returned $493 and $100 in everything else would have returned $5,787 – 3.5% vs. 9.8% annually (without dividends).

CONCLUSION

I can almost hear people saying, “This time is different.” And maybe AI will bring a new Golden Age, with profits for decades to come. We will just have to wait and see.

ADDENDUM

On July 10, the “Magnificent 7” was 37% of the S&P 500. From that level, they have declined $903 billion, -5.2%. The other 493 stocks are up 1.6%. This may, or may not, be the beginning of a shift in market sentiment to stocks with “less sizzle and more steak.” The only market forecast I have ever believed, and my favorite, is this from economist Herbert Stein, “If something cannot go on forever, it will stop.” This is easy enough to accept after it stops, but in frenzy and enthusiasm, it is easy to suspend belief in the statement.

Great story! Thank you for reminding us about stock market predictions.

This really echoes Howard Marks' book on cycles and to hold your wallet when the strong consensus for a trade and all the associated news is rosy. Thanks for sharing.